There isn’t much that’s easy about inheriting a home. First of all, most inherited homes mean the loss of a loved one and all the grief and heartache that comes with such a loss. Then, there’s the financial question of what to do with that inherited home? If you’ve jointly inherited the property with other relatives or siblings, it can be difficult to get everyone to agree on one course of action. If you’ve recently inherited a home, but aren’t sure what to do with it, it’s good to know that you have three basic options: move in, rent it out, or sell the home. Any choice has benefits and drawbacks, but before you even get that far, start with these steps to get the home ready for your next move:

Assessing the Situation

Before you decide what to do with the inherited home, it’s important to first have a very clear picture of where the home puts you and your family financially. Take the following steps before anyone makes a decision on the next move for the inherited home:

Talk to your financial advisor

Inherited homes can pose both financial benefits and drawbacks, which is why you need to talk to your financial advisor or tax attorney before you decide to move in, rent, or sell the property. There are some tax benefits that come with living in the home for more than two years, but if you don’t plan on moving in, you’ll also benefit from a stepped-up tax basis. This means that instead of owing a lot of back taxes because the home has appreciated so much in value over the years, you’ll only be taxed on the fair market value of the home at the time when you inherited. This can save you a lot in back taxes.

That said, it’s still not easy to keep up an inherited home, even if your loved one didn’t owe anything on their mortgage, and you don’t have to pay the bank. It takes a lot of money to keep a home running, from electricity and water bills to normal everyday touch-ups like replacing light bulbs and faulty wiring. That’s why your first step should always be to talk to a financial advisor, so you have a clear picture of how much the property will cost you, and if you can afford it.

Have the home inspected

In the same vein as talking to your financial advisor, it’s also prudent to have the home inspected. If your loved one had been living on the property for years, it’s likely that it’s been some time since its last inspection, and parts of the home may need repairing. An inspection will give you a better idea of what shape the home is in, and can clarify just how much you’ll need to spend before it’s move-in ready again.

Talk to your family members

Once you have a better idea of how much you’ll have to spend on the house, or how much it will cost to keep up, you can sit down with anyone else who jointly inherited the property with you. Talk about your goals and feelings for the property. Sometimes, one sibling will have a greater emotional connection with the property than others and may want to move into the house. In that case, the sibling moving in would be expected to pay other holders of the home either in rent or by simply buying them out of the property. If the house needs a lot of repairs, you and your family might decide that it’s in everyone’s best interest to simply sell the home as-is, and not worry about the hassle of fixing it up and finding a realtor.

Clear out the home

Regardless of how you decide to deal with the home, before anyone new can move in, or you can put the home up for rent or sale, you have to clear out your loved ones’ belongings. This can be a tough emotional process for everyone, but it’s good to designate a time when the family can get together and clear out the inherited home. Remember that this can be a difficult process, as some family members may want to take home the same belongings that hold sentimental value. Work to divide up the inheritance fairly, so no one feels left out.

Deciding on Next Steps

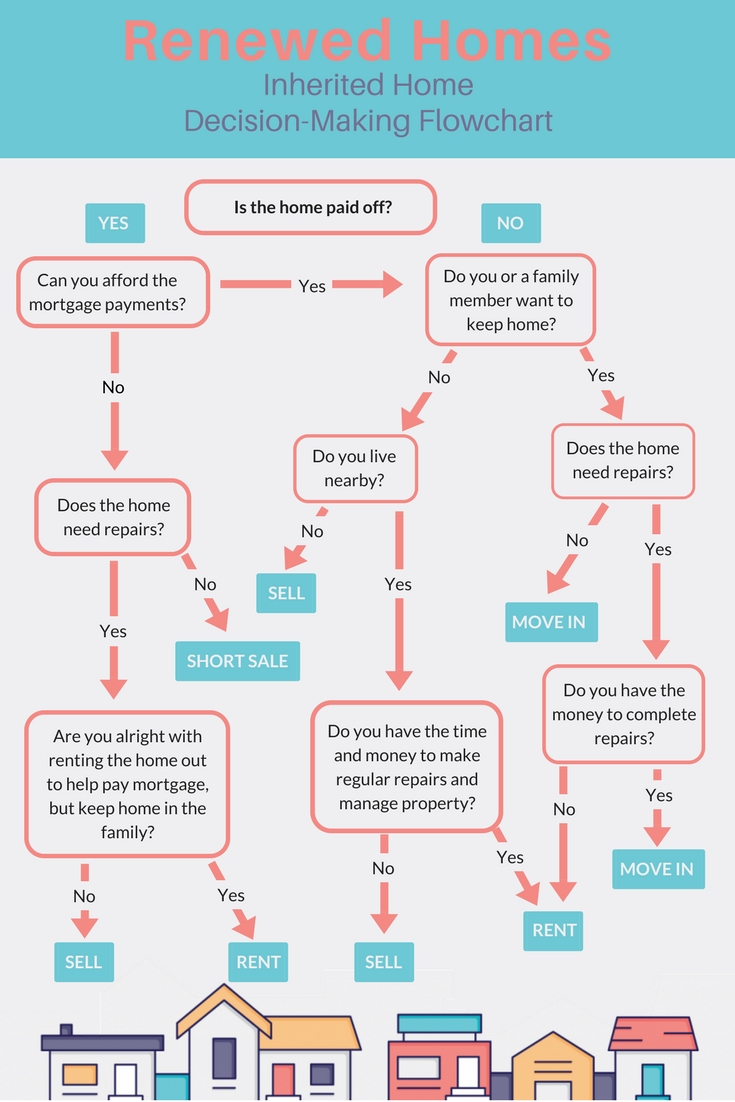

As we mentioned, when it comes to an inherited home, you have three choices: move in, rent out, or sell. We’ll explain some of the pros and cons of each option, so you have a good idea of which might work best for your situation. If you’re still not sure which is best, check out this handy flowchart:

What to do with an inherited home

Recent Comments